The solid progress of the Turkish woodworking machinery industry, which has undertaken significant investments and projects throughout the year to further strengthen its presence in the global woodworking machinery industry, increase export figures and diversify its markets, continues.

The solid progress of the Turkish woodworking machinery industry, which has undertaken significant investments and projects throughout the year to further strengthen its presence in the global woodworking machinery industry, increase export figures and diversify its markets, continues.

The woodworking machinery sector, which has turned into an industry over time from handicraft craftsmanship in regions where forest and wood usage areas are intense in Anatolia, has achieved a very important development over the years by combining the experience it brought from the past with technology. The sector, which first responded to the need for machinery in furniture manufacturing, which is its main sector in the domestic market, and became the driving force for its development, has now become a company that sells machinery not only to the domestic market but also to many countries of the world through its imports, production and trade.

Although its history dates back to ancient times, the real industrialization process of the woodworking machinery sector started in the 1980s. Until the early 1980s, the industry was dominated by stationary machines and manual labor processing solid furniture. However, over time, the use of different raw materials and materials in furniture production also led to the production of different machines for woodworking. The widespread use of panel manufacturing using tree branches, today known as chipboard and MDF, created a “revolution” effect in furniture in the early 1980s.

1990s were busy and filled with success for the sector

Both the speed of production and the cheapness of raw materials increased the interest of the USA and then Europe in these boards. This led to the need for machinery that directly processes these materials. The industry in Türkiye, which followed this process closely, initially produced small machines in this field. While the 1980s were spent getting used to such practices, the 1990s were remembered as a period when imported products entered our country intensively. Manufacturers who were affected by the import wind first reexamined their production, inspired by these products, and then immediately started manufacturing such products. Over time, the production of some necessary machines and the development of the sub-industry resulted in more technological machines. In summary, the 1990s were very busy and successful for the sector.

Great contribution to the Turkish machinery industry

The Turkish market has grown and developed very rapidly. In the 2000s, with the support of the sub-industry and international manufacturing companies starting to produce in Türkiye, the sector started to produce value-added products with high kilogram value. At this point, the contribution of the woodworking machinery sector to the Turkish machinery industry is increasing every year with its developing technology, increasing production and exports.

Transition from importing to manufacturing

The machinery industry, which has existed in Türkiye for a century, has gone through many development stages throughout its history. The machinery industry, which has made significant developments during this century, has moved from importing to manufacturing. Türkiye’s strategic geographical location at the intersection of Europe and Asia, combined with its qualified workforce, contributed to the growth of the machinery industry. Over the years, Turkish machinery manufacturers have focused on modernizing their production processes and adopting advanced technologies. The sector has diversified its product range to include industrial machinery, construction equipment, textile machinery and more, and has competed successfully, especially with its European rivals.

An assertive player in the global industry

The production, export and import figures of the sector, especially in the last 10 years, serve as sufficient evidence of this development. Industry representatives, who tried to gain a place in the sector with export figures not exceeding 10 million dollars in the early 2000s, have become important and assertive players in the global sector today. These successful developments were realized thanks to the significant investments made by the sector stakeholders in technology and a series of studies carried out with the determination to show themselves more clearly in the international arena.

A record was reached in exports in 2017

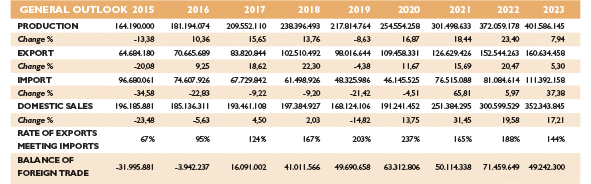

The woodworking machinery sector, with 95 million dollars’ worth of exports in 2013 against 208 million dollars’ worth of imports, continued to increase the figures by accelerating its efforts to increase exports in the following years. In 2016, where there was a 10.36 percent increase in production and a 9.25 percent increase in exports, imports decreased by 22.83 percent. In this 10-year adventure, 2017 has a special importance. For the first time in 2017, the export figure of the sector exceeded imports. In this regard, the woodworking machinery sector achieved a production of 210 million dollars, exports worth 84 million dollars, and imports totaling 68 million dollars in 2017. In the said year, the ratio of exports to imports was 124 percent and the sector managed to achieve a foreign trade surplus for the first time.

The woodworking machinery sector, which continued the success it achieved in 2017 in 2018, increased exports by 22.30 percent, and imports decreased by 9.20 percent. Accordingly, the sector realized 102 million dollars of exports and 61 million dollars of imports in 2018, and the ratio of exports to imports increased to 167 percent.

Manufacturers quickly adapted to the new normal

The sector continued its investments and production activities without interruption in 2021, when the pandemic rules were made somewhat flexible, the crises in deadlines were resolved, the exorbitant price increases in container prices began to reach a reasonable level, and in short, the whole world adapted to the new normal. The fact that international fairs, which could not be held for a while, started to be reorganized under the conditions of the pandemic, brought new momentum to the global sector. Although there was an increase in import figures with the opening of customs and the return of industry giants to the field, the increase in export figures continued in 2021. Industry representatives managed to take their goals one step further by breaking a new export record of 126 million dollars in 2021.

The sector in 2022

Despite the crisis that started in 2022 between Russia and Ukraine, one of the important target markets of the Turkish woodworking machinery industry, Türkiye continued its efforts to increase its exports without interruption. In 2022, when the foreign trade balance increased to 71 million dollars, the sector achieved production of 372 million dollars, exports of 152 million dollars, imports of 81 million dollars and domestic sales of 300 million dollars. In the sector, which increased its exports by 20.47 percent, its production by 23.40 percent and its domestic sales by 19.58 percent compared to the previous year, the ratio of exports to imports was 188 percent.

Sales of machines labeled “Made in Türkiye” to 150 countries

The Turkish woodworking machinery industry, whose commercial volume increased to 520 million dollars by the end of 2023, left behind a successful year despite the inflationary structure and a series of economic difficulties that increased its impact all over the world. There was an increase in the import figures of the Turkish woodworking machinery sector in 2023, when the presence of China in both production and exports, which remained closed for a long time during the pandemic period, was felt in almost all sectors. However, despite all the events, the sector did not pause its export-oriented investments. The sector, which achieved a 5.3 percent increase in exports compared to the previous year, sells machines labeled “Made in Türkiye” to 150 countries. The Turkish woodworking machinery industry, which exports over 1 million dollars to 40 countries, exports to 150 countries in total. The total exports of the sector, which exported the most machinery to the Russian market in 2023, amounted to 160 million dollars. Total imports of the sector, in which import figures increased by 37.38 percent compared to the previous year, reached 111 million dollars.

Local furniture companies are opening up to the world with Turkish machines

While the domestic sales figure of the sector, which was 89 million dollars in 2000, reached 331 million dollars in 2008, it decreased to 140 million dollars in the 2009 crisis. Domestic sales reached 467 million dollars in 2011, the highest figure in the last 13 years. This figure was the highest figure in domestic sales between 2011 and the present. The sector closed the end of 2014 with a domestic sales figure of 293 million dollars. This revealed that the sector increased its domestic sales by 230 percent from the year 2000 to the end of 2014. In 2017, when the sector broke the export record, domestic sales amounted to 194 million dollars. While domestic sales of 191 million dollars were realized in 2020, the sector made domestic sales of 251 million dollars in 2021 and 300 million dollars in 2022. Domestic woodworking machines, which increase their presence in the country along with their recognition in foreign markets, are frequently preferred by the furniture industry today. Turkish machines are preferred by local furniture companies for their product quality, short delivery times and especially for the after-sales services. Thus, domestic furniture companies are expanding abroad with the products they produce with domestic woodworking machines.

10 thousand people are employed in the sector

There are 423 registered manufacturers in total in the machinery industry with Nace code 28.49.12, which includes the woodworking machinery industry. According to AIMSAD’s predictions, approximately half of this number is in the woodworking machinery industry. According to the data from the TOBB (The Union of Chambers and Commodity Exchanges of Türkiye) Industry Database, a total of 10,300 people are employed in the industry of machine tools for working wood, cork, bone, hard rubber, hard plastics or similar materials, also including the woodworking machinery sector. Among these, there are 6,275 manual workers, 738 engineers, 841 technical personnel, 1009 foremen, and 1,429 administrative staff.

A glimpse to the machinery manufacturing industry

The machinery manufacturing industry, which has a special place in the manufacturing industry, is categorized as engineering industry and mechanical engineering industry. Since it provides input to almost the entire manufacturing industry, the machinery manufacturing industry is a driving force for other sectors. In other words, the development of machinery manufacturing also leads to the development of other manufacturing industries. The machinery manufacturing sector, with the inputs it provides from within the manufacturing industry, assumes a priority and privileged function by manufacturing machines, parts and tools that produce a wide range of goods and services for other sectors of the industry, and by presenting the products produced by these machines to consumers worldwide. In the machinery manufacturing sector, where project, R&D and engineering designs are required at every stage; Machines, machine parts and tools go through the design and project phase, are re-planned and put into production according to the request of the customer and the diversity and functions of other products. Again, tools and apparatus are changed and reproduced according to user requests. Since R&D studies play an important role in the development of the sector, R&D lives side by side with the machinery manufacturing sector. According to the Machinery Manufacturing Sector Türkiye and World Evaluation Report 2022 data prepared by the Turkish Machinery Federation (MAKFED), as the effects of the Covid-19 epidemic decreased in 2021, the world economy, which had contracted by 3.4 percent in 2020, grew by 5.8 percent in 2021. There was a high growth in machinery and equipment investments as a result of the increase in demand created by the return to economic and social activities in the world economy and the restructuring in the supply chain with the new normal conditions after the pandemic. Supply problems continued in the world economy in general in 2021. This trend also stimulated new investments for domestic supply purposes. Due to these developments, world machinery and equipment investments, which shrank by 8 percent in 2020, grew by 16 percent in 2021. In Türkiye, there was a high growth in machinery and equipment investments and demand with the effect of increasing domestic and especially foreign demand. In 2021, machinery and equipment investments grew by 61.8 percent in nominal terms and 22.8 percent in real terms. There were positive conditions on the demand side for the machinery and equipment industry throughout 2021. Post-pandemic conditions have led to a rapid growth in machinery and equipment investments around the world. Accordingly, the demand for machinery and equipment also increased. In Türkiye, the supports given to the machinery industry in recent years played an important role in encouraging initiatives. In addition, after the pandemic, nearby supply and supply security trends gained importance, and Türkiye gained a significant advantage in this regard and faced additional supply demand. Additional supply demand led to a jump in new capacity investments in the country, especially in the manufacturing industry. Accordingly, a rapid growth began to be experienced in the demand for machinery and installations in the country. All these developments also strengthened the entrepreneurship tendency in the machinery sector. While 38 thousand 298 enterprises were operating in the machinery sector in 2015, this number reached 46 thousand 225 in 2020. The number of startups increased significantly in 2021, reaching 51 thousand 062. Depending on the developments in the number of enterprises in the manufacturing industry, the share of entrepreneurs in the machinery sector throughout the manufacturing industry was 10.19 percent in 2015, and increased to 11.29 percent in 2020 and 11.49 percent in 2021.

Turkish woodworking machinery sector in the Covid-19 pandemic

In 2019, when the Covid-19 pandemic, which affected the whole world in a short time and brought with it a new world order that had not been experienced before, was first seen in China; While there was a small decrease of 4.38 percent in exports in the Turkish woodworking machinery sector, import rates decreased by 21.42 percent compared to the previous year. In the same year, the sector achieved production of 218 million dollars and domestic sales of 168 million dollars. In 2020, when the effects of the pandemic were felt most clearly in Türkiye and trade almost came to a halt all over the world, the sector successfully passed a difficult test. While machine production and sales were reduced to a minimum level in many countries that dominate the sector, manufacturers in Türkiye began to make new investments in the field of production and increase capacity in order to respond to the demand shifting to Türkiye from other countries. As a result of these devoted efforts, an increase of 16.87 percent in production figures, 11.67 percent in export figures and 13.75 percent in domestic sales figures was achieved, while the decline in imports continued with a contraction of 4.51 percent. In addition, the export-import coverage ratio increased to 237 percent in 2020. This figure was recorded as the highest export-import coverage ratio ever.

Türkiye’s trade with the world is increasing every year

Looking at the world in general, the total exports of the sector have reached 9.6 billion dollars in 2022. China, which ranked in the top three, exported 2.5 billion dollars, Germany 2 billion dollars and Italy 1.3 billion dollars. These countries accounted for approximately 60 percent of total exports. In line with this information, Türkiye ranked 11th in the world and 7th among European countries with its exports of 155 million dollars in 2022. At the end of 2022, Türkiye exported mostly to Russia, Serbia, Iraq, Bulgaria and Iraq. We see that there was 8.7 billion dollars of imports worldwide in 2022. The top three importing countries are America with 1.7 billion dollars, Germany with 577 million dollars and Canada with 399 million dollars; These countries accounted for almost 32 percent of total imports. In this context, Türkiye ranked 25th in the world and 13th among European countries with an import of 85 million dollars in 2022. When the import figures as of the end of 2002 are examined, Türkiye imported goods from China, Italy and Germany, which are the most important players in the sector.